Market Due Diligence – 1997

1. Substance

Within the discipline of M&A - the buying and selling of companies - it is common practice to examine legal matters, financial matters, and production technology (broadly understood). If external assistance is used, these would be lawyers, accountants, and engineering consultancies.

Today, it is common for private equity funds and others to also perform what we call Market Due Diligence. We developed our concept in a long-standing collaboration with private equity funds such as Axcel and corporate funds such as Velux.

Market Due Diligence focuses on the company's relationship with customers and opportunities to grow - primarily through organic growth.

2. Benefits

Without a thorough understanding of the market position, trends, customer relations, and the internal organisation of sales and marketing, it is difficult to value/assess a company.

A "market due diligence" will also reveal whether the company has made itself look more attractive than it really is. In the media, there have been glaring examples of top- and bottom-line financial statements of traded companies being "made up" to such an extent that prison sentences have subsequently been handed down.

3. More Information

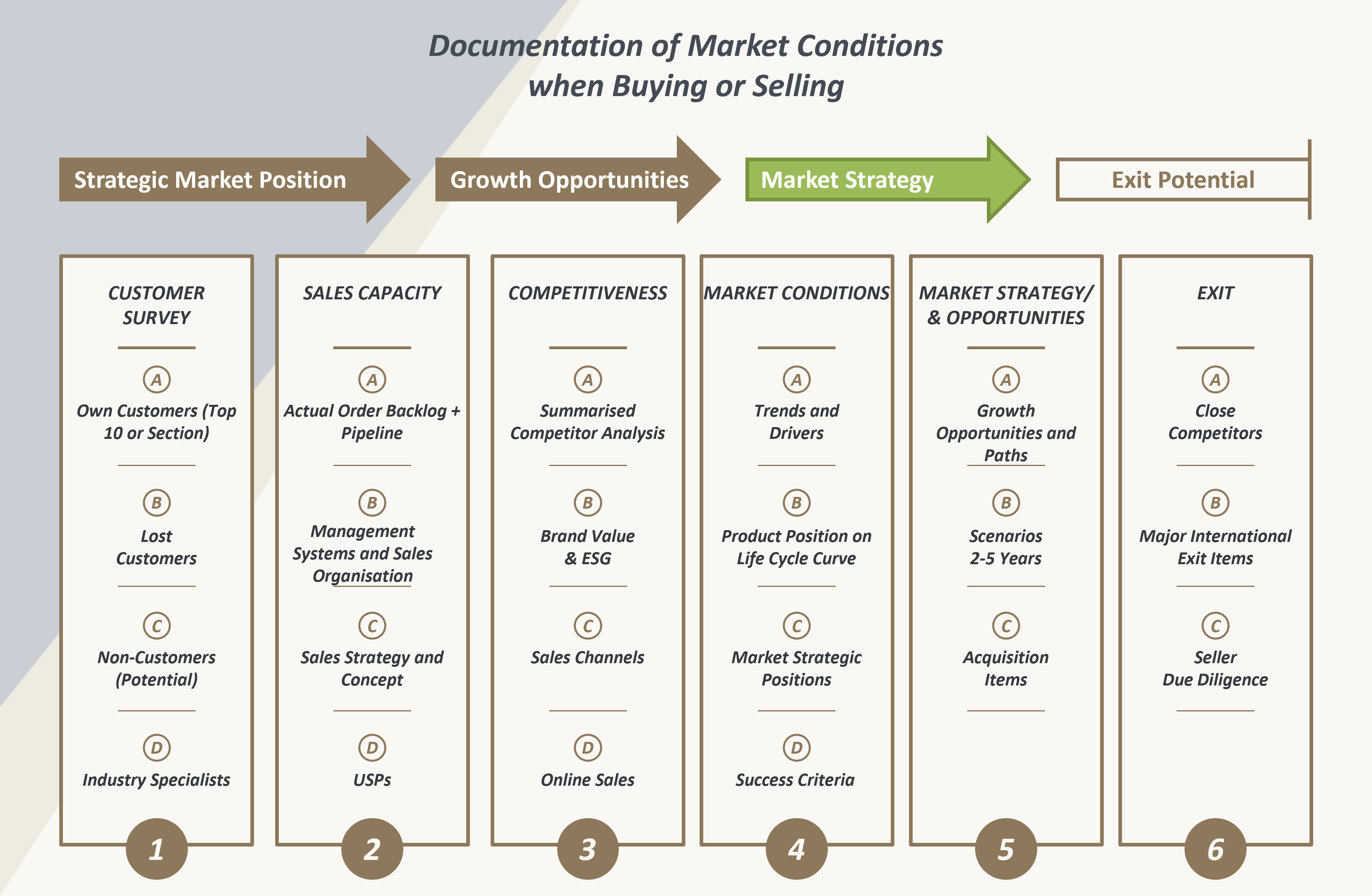

Below is one of the tools we developed to perform “Market Due Diligence”.